A Health Savings Account, or HSA, is way to save for medical expenses and reduce your taxable income.

Qualifying for an HSA

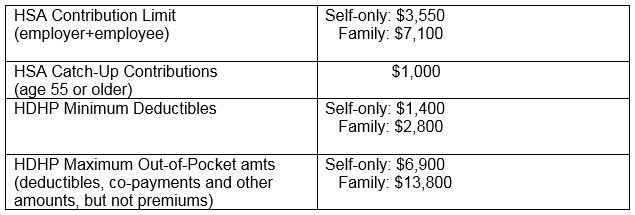

If you are enrolled in a high-deductible health insurance plan (HDHP) as defined by the government. These plans are re-defined each year by the IRS, which determines the minimum deductible they must have and the maximum amount a planholder can spend out-of-pocket. Below are the minimums and maximums for 2020. Bear in mind some plans have high deductibles but don’t qualify you for an HSA. Look for plans specifically tagged “HSA-eligible” if you want the account option.

How an HSA works

Some employers that offer high-deductible health plans also offer HSAs. If yours doesn’t, you can open a separate HSA account as long as you have a qualifying plan.

Each year, you decide how much to contribute to your HSA account, though you cannot exceed government-mandated maximums. If you have an HSA through your workplace, you can set up easy automatic contributions directly from payroll.

You will receive a debit card or checks linked to your HSA balance, and you can use the funds on eligible medical expenses. This includes deductibles, copays and coinsurance, plus other qualified medical expenses not covered by your plan. Please note insurance premiums usually cannot be paid for with HSA funds.

HSA balance rolls over from year to year, unlike your Flexible Spending Accounts, so you never have to worry about losing your savings. Once you’re over age 65 and enrolled in Medicare, you can no longer contribute to an HSA, but you can still use the money for out-of-pocket medical expenses. If you use the money on non-eligible expenses, you have to pay income tax on that amount (plus a penalty if you’re under 65).

Benefits of an HSA

HSA accounts offer several benefits to you as the owner a few of which are, offering tax advantages on the funds deposited into the account, they’re a great way to make sure there’s always some money in an emergency health fund, it’s a way budget in a set amount to input regularly for medical expenses then have that to draw from rather than having to pull from a regular savings account, it helps make high deductibles more manageable, and more!